5G-Advanced Era Base Station Antennas: Technological Iteration and Market Structure Reconstruction

In cellular mobile communication systems, antennas serve as core converters between circuit signals and spatially radiated electromagnetic waves, undertaking the key function of signal transmission and reception. As a core component at the edge of mobile communication networks, their performance directly determines wireless network coverage quality, spectrum efficiency, and user experience. From a global perspective, as 5G networks evolve from extensive coverage to in-depth optimization, the commercialization process of 5G-Advanced (5G-A) is accelerating worldwide. Base station antennas are evolving into system-level products integrating high-frequency radio frequency, intelligent algorithms, and green design, driving the global industry into an era of high-quality intensive development.

I. From 4G to 5G-A: The Iterative Upgrade Path of Antenna Technology

In the 4G era, standard macro base stations consisted of three parts: Baseband Processing Unit (BBU), Radio Remote Unit (RRU), and antenna feeder system, which later gradually evolved into 4T4R and 8T8R MIMO antenna forms. Entering the 5G and 5G-A stages, antenna technology has undergone two core leaps, with the depth of technological iteration continuously deepening

(1) Order-of-Magnitude Leap in Performance Requirements

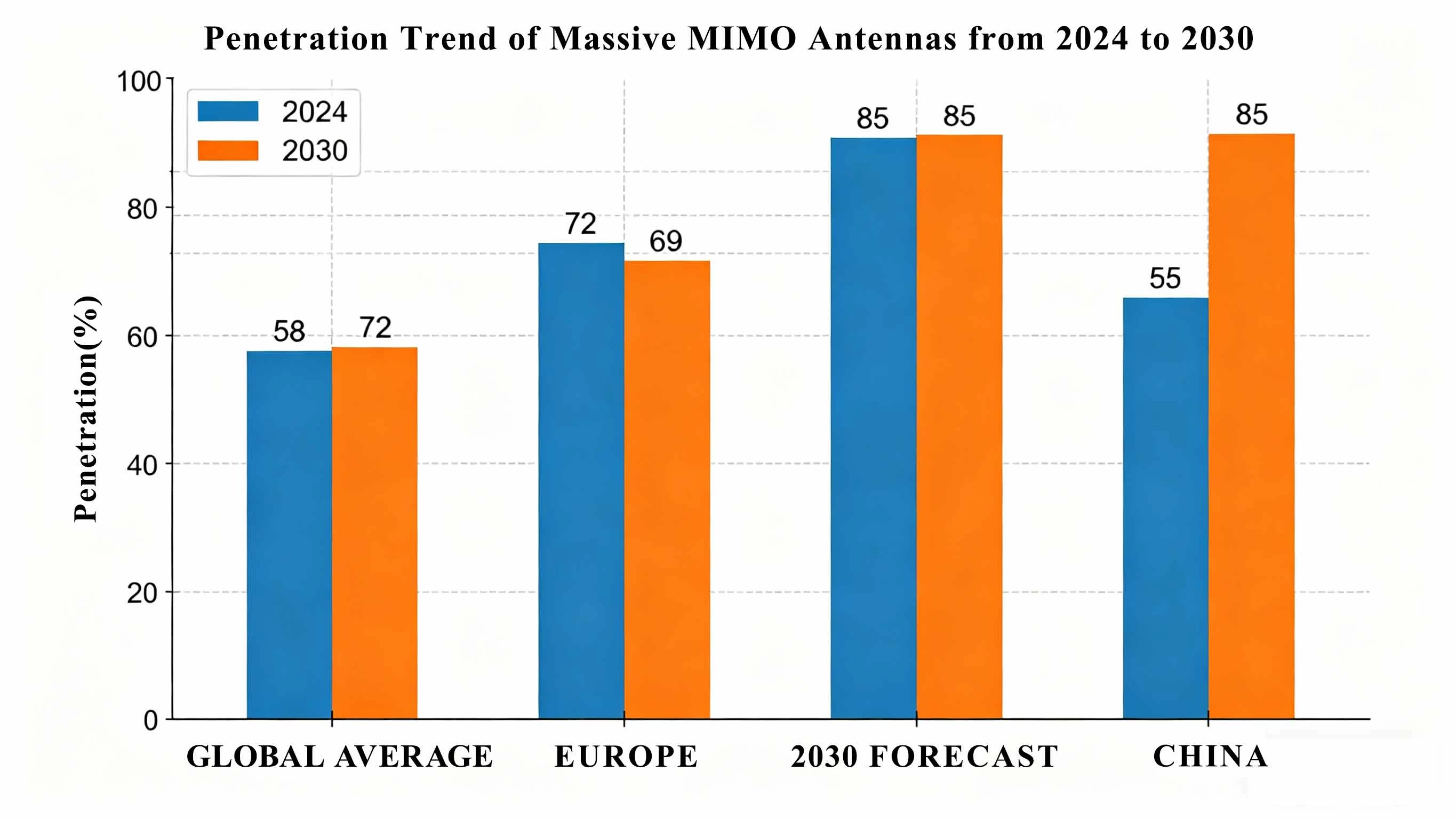

Compared with 4G, 5G has improved spectrum efficiency by 5-10 times. Meanwhile, 5G-A's pursuit of "gigabit experience" and "deterministic low latency" has further driven the upgrading of antenna performance globally. To support carrier aggregation above 200MHz and high-order MIMO requirements of 12TR/16TR, mainstream global antenna manufacturers are advancing R&D on multi-band fusion and compatibility technologies for 700MHz low-frequency wide coverage and 4.9GHz and above high-frequency large capacity. The continuous upgrading of massive MIMO technology has become a global consensus: the number of antenna elements is evolving from 64T64R to 128T128R, and the value per base station antenna has increased by approximately 40% compared with the initial stage of 5G. In some high-frequency scenarios, the number of antenna elements has exceeded 1,024 arrays. In terms of penetration rate, by the end of 2024, the penetration rate of massive MIMO antennas in domestic 5G base stations had reached 65%, with a global average penetration rate of about 58%. Among them, the penetration rates in developed regions of North America and Europe reached 72% and 69% respectively. It is expected that the global penetration rate of massive MIMO antennas will uniformly rise to around 85% by 2030.

The following line chart intuitively shows the changing trend of the penetration rate of massive MIMO antennas globally and in major regions from 2024 to 2030:

(2) Structural Transformation in Form and Function

The transformation from passive antennas to Active Antenna Units (AAU) has been fully completed, and the integration level of AAU is continuously deepening. In the 5G era, the shift from "RRU + antenna" to AAU eliminated feeder loss through direct optical fiber connection to BBU and reduced deployment costs. Entering the 5G-A stage, AAU has further integrated AI intelligent algorithms, which can real-time sense user density, movement trajectories, and interference environments, dynamically optimize beam pointing and power allocation, increasing cell edge rate by over 38%. At the same time, green and low-carbon has become a rigid requirement. Technical indicators such as liquid cooling heat dissipation, application of low-loss materials, and 30% structural weight reduction have been incorporated into operator centralized procurement standards, promoting the transformation of antennas from "energy-consuming units" to "energy-saving nodes".

II. Deepened Structural Upgrade: Value Chain Reconstruction Led by AAU

In the 5G-A era, the in-depth integration of AAU has further reshaped the value chain structure of base station antennas, with core value links shifting to high-frequency materials, active devices, and intelligent algorithms:

In terms of hardware composition, AAU integrates the core functions of traditional antennas and RRU, and its digital interface can independently control each antenna element to form an active antenna array, which has become the global mainstream technical route. The demand for high-frequency signal transmission has driven the upgrading of upstream materials worldwide, making high-frequency PCB and high-frequency copper-clad laminates carrying antenna elements the core beneficiary segments, with their application proportion in the RF front-end increasing significantly. Compared with the 3G and 4G eras, 5G-A high-frequency PCB has higher requirements for material purity and processing accuracy. Currently, the average price of global RF front-end PCB has exceeded 3,500 yuan per square meter, which is more than 1.75 times that of the 4G era. Among them, the high-end markets in Europe and America have higher technical requirements, and the price is 20%-30% higher than the global average level. In terms of industrial chain distribution, China and South Korea account for more than 75% of the global high-frequency copper-clad laminate production capacity, while European and American enterprises still have technical advantages in high-end material formulations and processing equipment.

The value proportion of active devices is continuously rising, becoming the core pillar of the value chain. According to the 2024 semi-annual report data of Tianfu Communication, the revenue proportion of its active devices exceeded 50% for the first time, reaching 53%, with gross profit margin increasing to 46.84%. In the same period, although the gross profit margin of passive devices still maintained a high level of 68.94%, its revenue growth rate was significantly lower than that of active devices. This trend reflects that with the improvement of antenna intelligence, high-value-added products integrating active devices such as GaN (Gallium Nitride) power amplifiers have become the focus of industry competition, forcing enterprises to transform towards integrated design to reduce BOM costs.

III. Market Structure: From Scale Expansion to Intensive Cultivation, Competition Presents "One Dominant Player and Multiple Strong Competitors" Pattern

The global base station antenna market has bid farewell to the era of extensive scale expansion and entered an intensive development era centered on quality improvement and scenario adaptation. The market size is steadily growing with continuous structural optimization. From a regional perspective, Asia, Europe, and North America have become the three core global markets, accounting for more than 90% in total. Among them, the Asian market accounts for 52% due to the network construction demand of emerging economies such as China and India, becoming the core engine of global growth.

(1) Market Size and Structural Characteristics

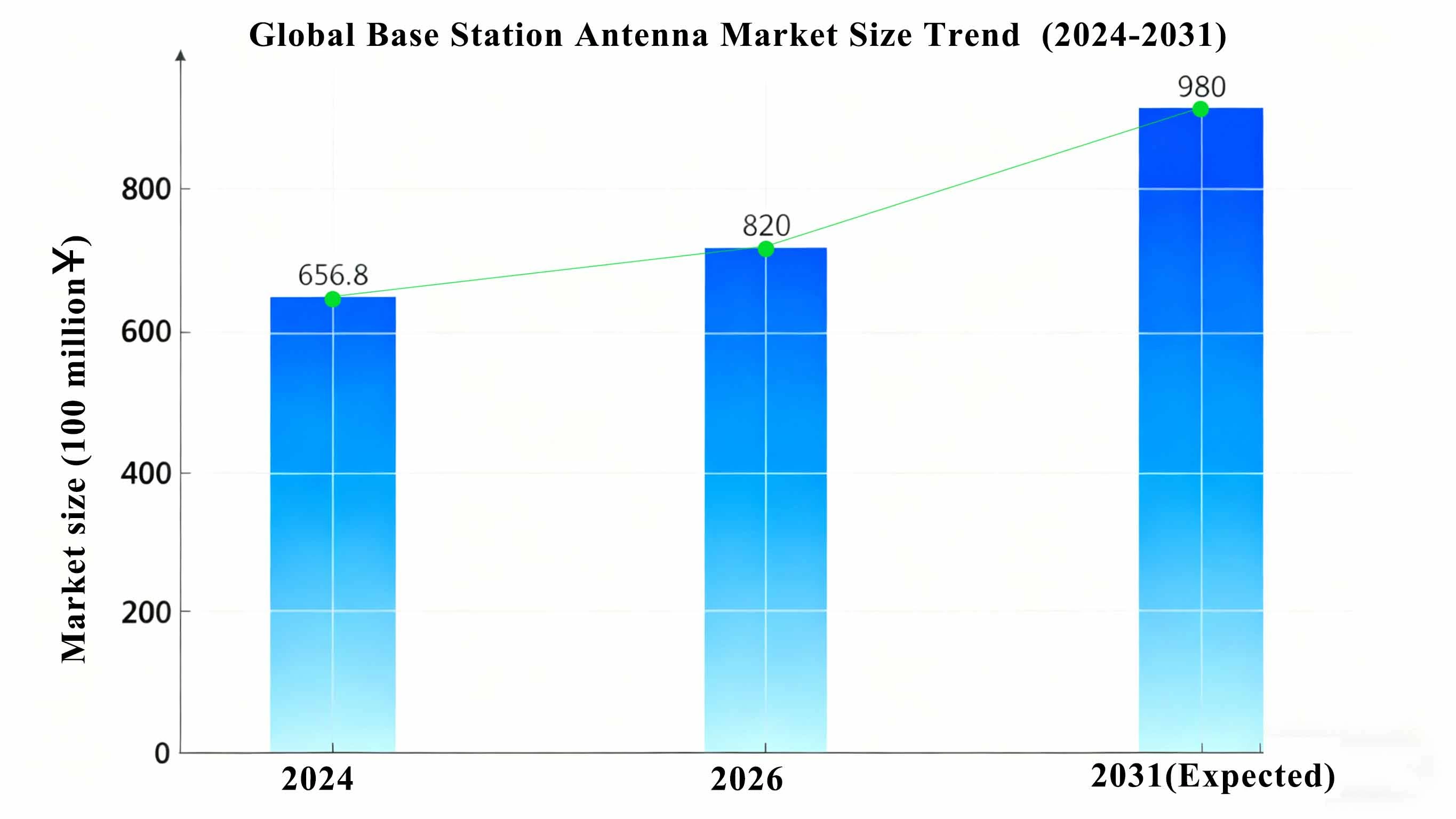

According to the joint data of the International Telecommunication Union (ITU) and the Ministry of Industry and Information Technology of China, by the second quarter of 2024, the total number of global 5G base station deployments was about 5.94 million, among which China had built a total of 4.251 million 5G base stations, accounting for more than 60% of the global total, with an average of 30.2 5G base stations per 10,000 people, far exceeding the global average of 12.8. In terms of market size, the global cellular base station antenna market size reached 65.68 billion yuan in 2024, of which the Chinese market size reached 16.026 billion yuan, accounting for about 24.4% of the global share. The global 5G/LTE cellular antenna segment market size was about 25.97 billion yuan, and it is expected to approach 45.26 billion yuan by 2031, with a CAGR of 9.5% in the next six years. In terms of structure, the global 5G base station antenna accounted for 62% in 2024, and the demand proportion of high-frequency band (millimeter wave) antennas increased to 10%. Among them, the penetration rates of millimeter wave antennas in North America and Europe reached 18% and 15% respectively, significantly higher than the global average level. The remaining 28% came from 4G network optimization and emerging market coverage projects. Looking forward to 2026, the global base station antenna market size is expected to exceed 82 billion yuan, a year-on-year increase of about 25%. The growth momentum mainly comes from network construction in emerging Asia-Pacific markets, 5G-A upgrades in Europe and America, and refined scenario deployment, rather than a simple surge in the number of new macro base stations.

The following charts respectively show the growth trend of the global base station antenna market size and the regional comparison of millimeter wave antenna penetration rate in 2024:

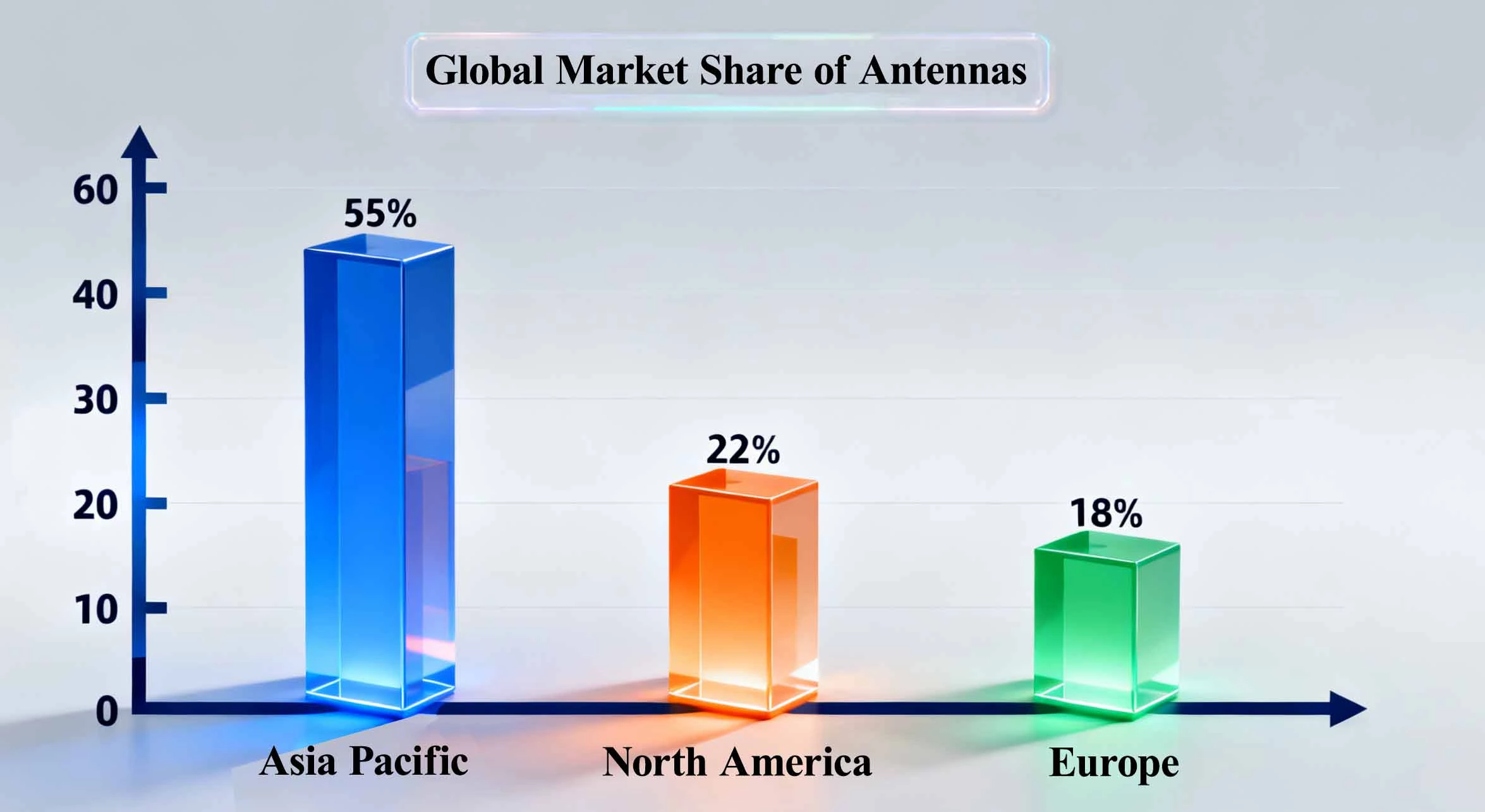

The global regional distribution presents the characteristics of "Asia-Pacific dominance and European-American high-end leadership": relying on the advantage of network construction scale, the Asia-Pacific region (including China) will account for 55% of the global base station antenna procurement volume in 2025. Among them, the Pearl River Delta region has gathered more than 40% of the world's leading enterprises, forming a millimeter wave antenna testing and certification center. The North American market focuses on high-end technical scenarios, with a market share of about 22% in 2025. There is strong demand in the fields of millimeter wave antennas and vehicle networking dedicated antennas, and the unit price is more than 40% higher than the global average level. The European market has a share of about 18%, with network optimization and green energy-saving antennas as the core demand, having the highest requirements for antenna environmental protection indicators in the world. The domestic regional distribution presents the characteristics of "strong east and advancing west, multi-point breakthroughs": relying on the advantage of industrial agglomeration, the East China region will account for 32% of the national base station antenna procurement volume in 2025. Benefiting from the "East Data West Computing" project, the market share of the central and western regions has increased to 18%, and the procurement volume of base station antennas in rural and remote areas has increased by 28% year-on-year, significantly higher than the 15% average growth rate in urban areas. Indoor distributed antennas have become a common incremental market worldwide. In January 2025 alone, China Mobile's centralized procurement scale of indoor distribution antennas reached 15.88 million units, while Verizon in North America's indoor antenna procurement volume reached 3.2 million units in the same period, covering various types such as omnidirectional ceiling-mounted and directional wall-mounted antennas, adapting to the high-speed connection needs of scenarios such as office buildings and shopping malls.

The following bar chart shows the market share distribution of base station antennas in global and Chinese regions in 2025:

(2) Competitive Landscape and Enterprise Competitiveness

The global base station antenna market presents an oligopoly pattern of "one dominant player and multiple strong competitors, regional fragmentation". Three enterprises including Huawei, Ericsson, and CommScope together account for more than 60% of the global market share. Among them, relying on the advantage of end-to-end solutions, Huawei's global base station antenna shipment share reached 38.93% in 2024, ranking first for nine consecutive years, with its market advantages mainly concentrated in the Asia-Pacific, Middle East, and African regions. Ericsson and CommScope dominate the European and American high-end markets, with global shares reaching 12.7% and 10.3% respectively in 2024. Among them, CommScope's market share in North America exceeds 35%, and Ericsson's market share in Europe reaches 28%. The right to speak of domestic enterprises in the global core technology field is continuously improving. The proportion of international standards related to 5G antennas led by China has increased from 28% in 2018 to 47% in 2023. Among the world's top ten base station antenna manufacturers, Chinese enterprises occupy 4 seats. In addition to Huawei, ZTE, Jingxin Communication, and Tongyu Communication have global shares of 5.2%, 4.8%, and 3.5% respectively.

Global enterprise competition shows obvious regional differentiation characteristics: leading enterprises realize global layout relying on technological advantages. Huawei deepens the Asia-Pacific market, and at the same time actively expands European compliance certification, and cooperates with Middle Eastern countries to build 5G-A networks. The gross profit margin of Tongyu Communication's base station antenna business has increased to 32.5%, and the proportion of overseas market revenue has exceeded 40%, mainly covering emerging markets in Southeast Asia and Latin America. International specialized, sophisticated, distinctive, and innovative enterprises have significant advantages in segmented fields. For example, Amphenol of the United States has a 25% global share in the field of vehicle-mounted cellular antennas, and Kathrein of Germany is technologically leading in the field of millimeter wave phased array antennas, with a global share of about 18%. Domestic specialized, sophisticated, distinctive, and innovative enterprises have also achieved breakthroughs in segmented fields. For example, Shenglu Communication's product performance in the field of millimeter wave phased array antennas is comparable to that of international giants. It is worth noting that the global industry gross profit margin shows a differentiated trend. Due to fierce competition, the global average price of standard antenna products dropped by 15-20% from 2022 to 2023, and the gross profit margin of small and medium-sized enterprises was compressed to below 18%. However, the gross profit margin of high-end products such as millimeter wave antennas and green energy-saving antennas remains above 45%. Among them, the gross profit margin of green antennas in the European market is as high as 52%, 25 percentage points higher than that of traditional products.

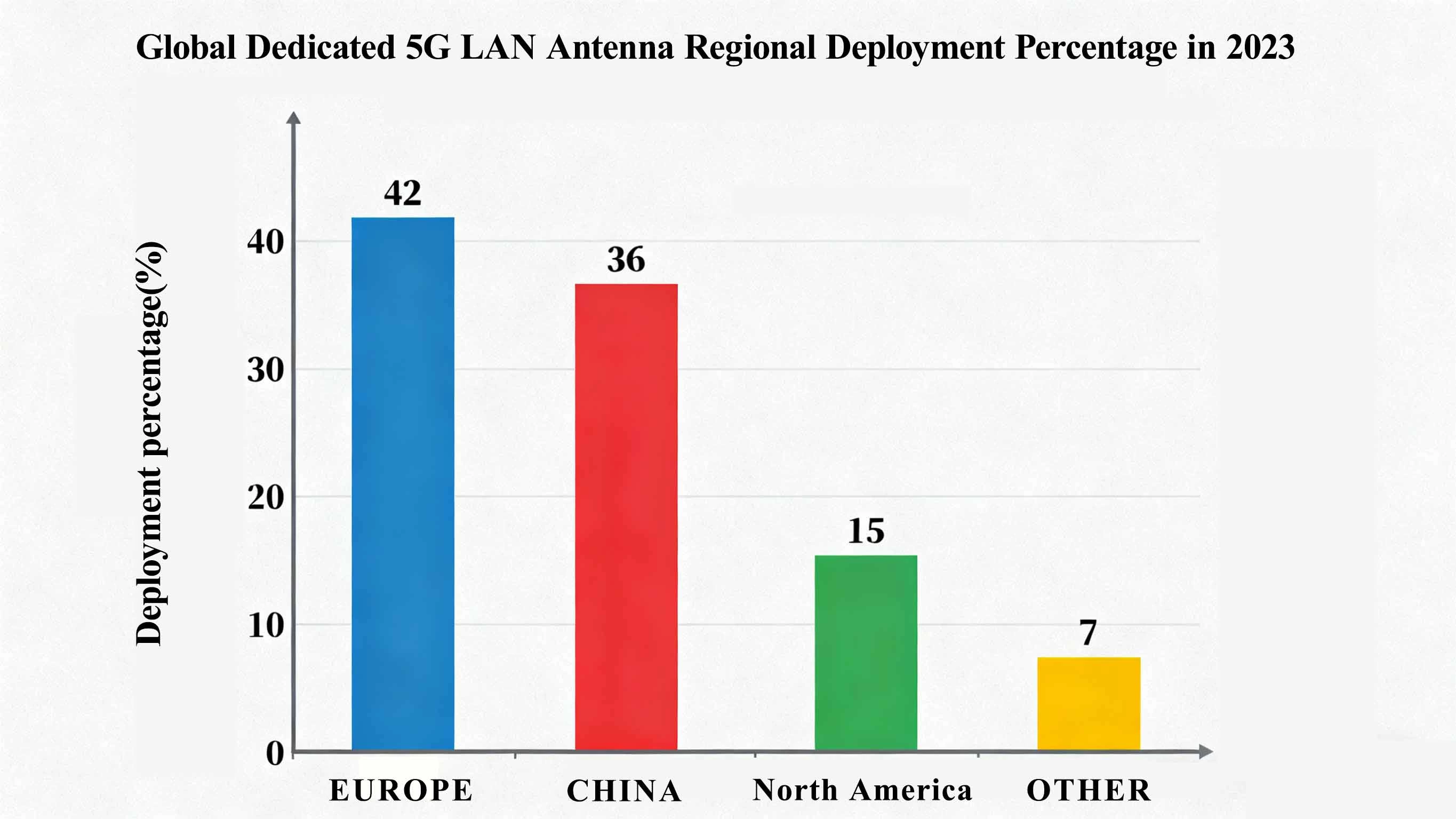

IV. Future Trends: Towards 6G Pre-research and Integration of Communication, Sensing and Intelligence

With the global advancement of 5G-A commercialization, the base station antenna industry is ushering in a new round of technological reserve and scenario expansion cycle. At the technical level, 6G pre-research has become a global consensus. Although cutting-edge technologies such as terahertz band antennas, distributed cell-free architecture, and Reconfigurable Intelligent Surfaces (RIS) have not been commercialized, global leading enterprises such as Huawei, Ericsson, and Samsung have reserved interfaces and algorithm frameworks in 5G-A antennas to pave the way for future smooth evolution. At the application level, the integration of communication, sensing and intelligence has become the core global direction. The adaptability of antennas in vertical scenarios such as industrial internet and vehicle-road coordination is continuously improving. In 2023, the global deployment volume of dedicated 5G LAN antennas reached 352,000 sets, of which Europe accounted for 42% and China accounted for 36%, supporting the delay of intelligent manufacturing units to below 8ms. The global construction of vehicle networking CV2X road-side units has driven the shipment of high-precision positioning antennas to increase by 187%, with North America and China being the main growth markets.

The following line chart shows the regional deployment distribution of global dedicated 5G LAN antennas and the growth trend of high-precision positioning antennas in 2023:

In general, the global base station antenna industry has entered a critical transition period from scale expansion to quality improvement. Technological iteration (high-frequency, intelligence) and regional coordination (Asia-Pacific increment, European-American quality improvement) will jointly drive industrial development. As the world's largest base station antenna production and consumption market, China has production capacity advantages in the mid-to-low-end product field, and is accelerating its breakthrough into the high-end market. The European and American markets lead the development direction of high-end antennas by virtue of technological standards and scenario advantages. In the future, green energy conservation, scenario customization, and 6G technological reserves will become the core track of global enterprise competition, promoting the industry to move towards a new stage of high-quality development.