European Spectrum Policy Reform: A Critical Path to Unlocking 5G Investment Potential and Digital Competitiveness

Current Status and Challenges of 5G Development in Europe

Since the launch of 5G networks in 2019, European mobile operators have invested nearly €200 billion, expanding 5G coverage to 93% of the population. However, Europe is no longer a global leader in 5G deployment, losing the position it had in the eras of 2G, 3G and 4G. Compared with global 5G pioneer countries, Europe has obvious gaps in network quality, 5G standalone (SA) deployment and user experience.

Specific manifestations include:

- Average 5G download speeds in Europe are lower than leading regions

- 5G network consistency is poor, with more than one in five tests failing to meet the threshold of 25 Mbps download and 3 Mbps upload

- Mobile data usage is much lower than in other regions

- 5G SA deployment is lagging, with utilization rate less than 2%, while Greater China reaches 77%

Analysis of Spectrum Cost Issues

Excessively high spectrum costs are a key factor restricting the investment capacity of European mobile operators. Research shows:

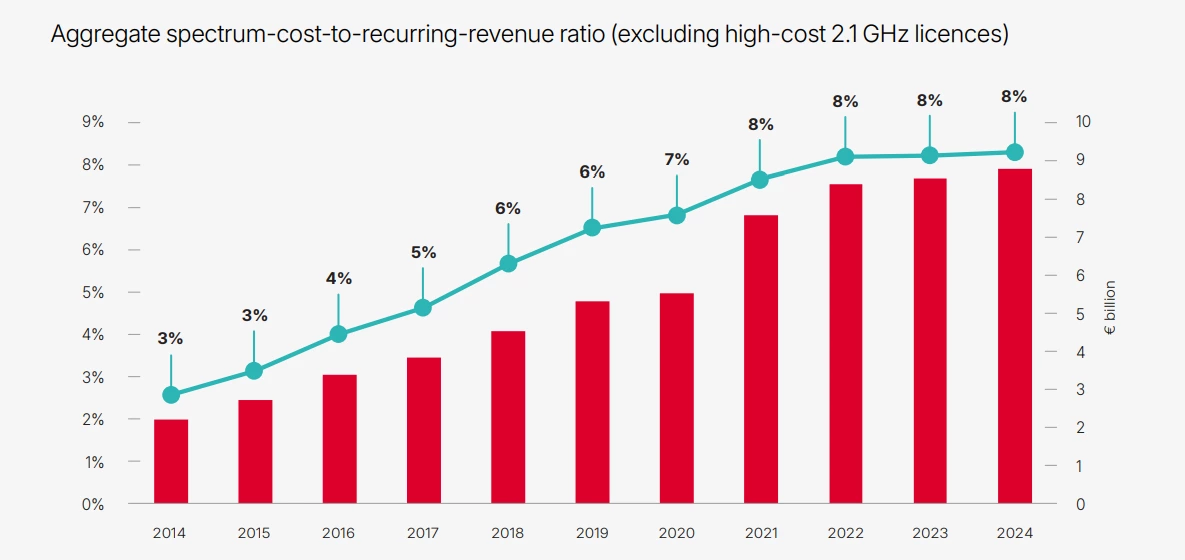

- Over the past 10 years, the proportion of spectrum costs in operators' revenue in Europe has increased to about 8%

- Spectrum costs vary significantly among different European countries, with Italy, Austria and the Netherlands having the highest costs

- Policy decisions are important factors driving spectrum prices, including high reserve prices, auction design and spectrum scarcity

High spectrum costs have led to a vicious cycle: high costs → limited investment capacity → declining network quality → poor user experience → slow revenue growth → further limiting investment capacity.

Prospects for Spectrum License Renewals

In the next 10 years (2025-2035), there will be more than 500 spectrum licenses in Europe that need to be renewed, providing an important opportunity for policy reform.

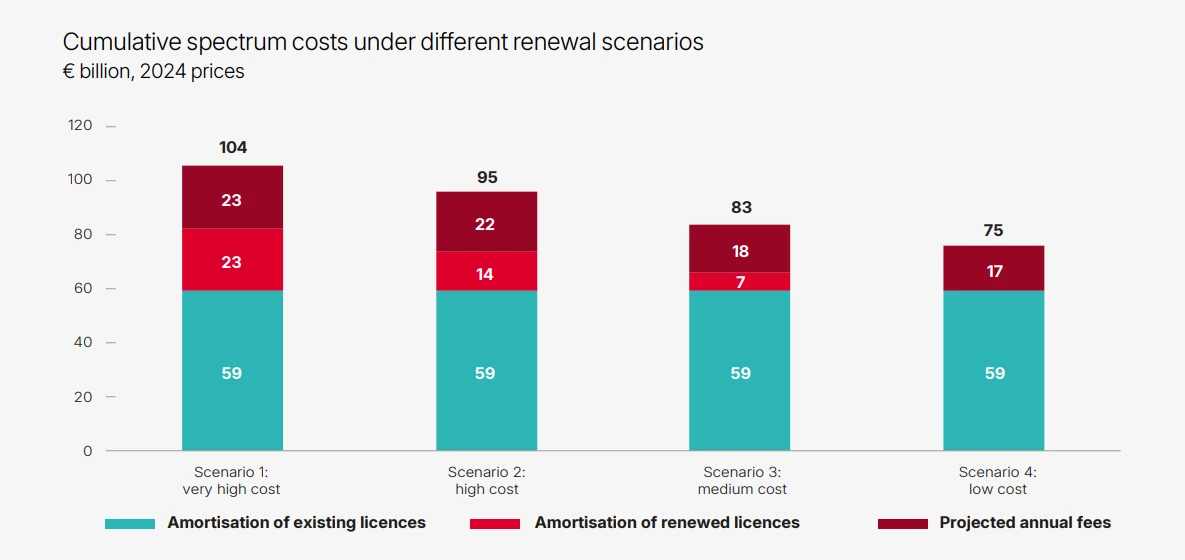

Different renewal pricing schemes will have completely different impacts:

- High-cost scheme: Renewal at historical prices will result in operators bearing €104 billion in spectrum costs between 2025 and 2035

- Low-cost scheme: Free renewal can save about €30 billion, equivalent to three times the investment required to upgrade all existing 5G networks to SA mode

Research shows that free renewal can increase network speeds by 23% and add €75 billion to Europe's GDP by 2035. Even under the low-cost scenario, operators will still bear €75 billion in spectrum costs, mainly from the amortization of existing licenses and annual fees.

Future Spectrum Demand and Planning

To meet the needs of 5G and future 6G, Europe needs:

- Ensure at least 2 GHz of mid-band spectrum by 2030, currently Europe has only allocated about 1 GHz

- Prioritize the allocation of the upper 6 GHz band (6.425-7.125 GHz), which can provide 700 MHz of spectrum

- Consider using the 3.8-4.2 GHz band for mobile, which can provide an additional 200-400 MHz

The allocation of these frequency bands will align Europe with leading countries such as the United States, China and India, ensuring that future networks will not experience capacity bottlenecks.

Policy Recommendations

Based on the research results, the report puts forward the following policy recommendations:

- Simplify the renewal process: Use administrative extensions instead of re-auctioning to avoid uncertainty

- Automatic renewal with indefinite duration: Provide operators with long-term regulatory certainty, with a minimum duration of 40 years

- Do not set aside spectrum: Do not reserve spectrum for new entrants or local use to avoid artificially inflating prices

- Renew in advance: Renew licenses well in advance of the expiry date to provide long-term certainty

- Set clear investment targets: Collaborate with the mobile industry to develop achievable connectivity goals

- Ensure sufficient spectrum: Ensure at least 2 GHz of mid-band spectrum by 2030, prioritizing the allocation of the upper 6 GHz band

Economic Impact Analysis

Different spectrum pricing schemes have significant impacts on the European economy:

- High-cost scheme: Limited GDP growth, with a maximum increase of €16 billion

- Medium-cost scheme: GDP growth can reach €47 billion

- Low-cost scheme: GDP growth can reach up to €74 billion

This indicates that adjusting spectrum pricing policies is not only beneficial to mobile operators, but will also have a positive ripple effect on the entire European economy.